SUMMARY OF POLICY

Our business is committed to excellent customer service and the resolution of any concerns or complaints quickly, fairly and efficiently. To ensure our scheme is compliant with ASIC requirements we use an IDR process that has been vetted by relevant industry bodies (FBAA, MFAA, & CAFBA).

- – We welcome complaints as a positive means of reviewing and improving our customer services. All complainants will be treated with respect, courtesy, and consideration.

- – Our internal dispute resolution scheme is open to anyone who deals with us: customers, dealers, lenders, other brokers or consultants, contractors, or any other person.

- – All representatives are expected to inform complainants about our IDR/EDR processes as soon as they become aware of a concern, to give high priority to resolving complaints quickly and to assist any complainant through the process.

- – The Responsible Manager will manage complaints.

- – Our Internal Dispute Resolution Manual complies with ASIC’s requirements and details how we manage and report complaints.

- – We are a member of the Australian Financial Complaints Authority (AFCA) Member # 14925 External Dispute Resolution (EDR) Scheme, as approved by ASIC. We accept EDR scheme decisions and implement their recommendations as soon as we are informed of them.

- – The Responsible Manager holds information on complaint statistics and any associated compliance breaches.

- – We will report to ASIC annually any compliance breaches indicated through the complaints process and the policies and procedures subsequently implemented to ensure there is no re-occurrence.

COMPLIMENTS AND COMPLAINTS

At Melbourne Finance Broking Pty Ltd “MFB”, we always work hard to build strong and lasting relationships with our valued customers. By listening to your feedback, not only can we address any immediate concerns you may have, we will also continually improve our products and services.

We know there are times when you may wish to compliment us on something we have done well and other times when you may wish to tell us we have not met your expectations.

Compliments

Our representatives are always delighted to know that they have succeeded in making your experience a pleasant and successful one.

If one of our representatives has provided you with exceptional service in any way, please let us know using the details below, so that we can further encourage them via this feedback process.

Concerns & Complaints

If, for any reason, you do not feel that you have received the highest standard of care from us, we likewise encourage you to share this with us. We have developed a process that we believe makes it easy for you to tell us of your concerns and for them to be addressed quickly and fairly.

You can contact us by whichever of the following means best suits you:

- – by telephone on 03 9429 3000

- – via email at [email protected] or

- – by post at

Customer Service Team

1 Elgin Place

Hawthorn Vic 3122

If you choose to contact us by mail or email, please make sure you provide as much detail as possible about your complaint.

How It Works

- You should gather any supporting documents or records with broker name, other names, times, and dates that will assist our investigation into your complaint.

- Get in touch to let us know about your complaint and how would like it resolved. The quickest way is to call or email your personal broker representative or our complaints handling officer as detailed above.

- We will acknowledge your complaint, give you a reference number and the name and contact details of the person who will handle the complaint.

- We will do what we can to remedy your problem, making sure it does not occur again for you and let you know once we have a resolution.

How Long Will It Take?

We will try to deal with your complaint on the spot or within days.

However, if this is not possible, we will write to you to acknowledge your complaint within 5 days. We will ensure we treat you fairly and will work to resolve your complaint as soon as possible. In the rare event we are still investigating your complaint after 30 days we will write to you to explain why and to let you know when we expect to have completed our investigation. When we have completed our investigation, we will write to let you know the outcome and the reasons for our decision.

Need An Update On Your Complaint?

If you have lodged a complaint with us, you can contact us any time to ask for an update on its status. Contact us through any of the methods listed above and be sure to refer to your earlier communication so that we can respond effectively.

Taking It Further- If you’re unhappy with the resolution

We hope that you will be satisfied with how we deal with your complaint. However, if your concerns remain unresolved, or you have not heard from us within 30 days, then you can have your complaint heard by an external independent party, the Australian Finance Complaints Authority (AFCA).

Our AFCA Membership Number is: #14925

You can contact AFCA at:

- – by telephone on 1800 931 678 (free call)

- – via email at [email protected] or website at www.afca.org.au

- – by post at

Australian Financial Complaints Authority

GPO Box 3,

Melbourne VIC 3001

External dispute resolution is a free service established to provide you with an independent mechanism to resolve specific disputes.

INTERNAL DISPUTE RESOLUTION (IDR) PROCEDURE POLICY

IDR Information

We believe that it is essential for our customers to be able to identify and deal with a senior and responsible person who has the ability, authority, and proper training to hear and respond appropriately to any complaint or dispute. It is a requirement under the National Consumer Protection Act 2009 that we have in place an Internal Dispute Resolution Procedures (IDR) that comply with the standards and requirements made and approved by ASIC RG271 (September 2021) and that cover disputes in relation to the credit activities engaged in by us and our credit representatives.

Receiving Complaints

Complaints can be lodged by contacting the Disputes Officers by:

- – by telephone on 03 9429 3000

- – via email at [email protected] or

- – by post at

Customer Service Team

1 Elgin Place

Hawthorn Vic 3122

or by speaking to any representative of our business who will refer complainants to the complaints/ Disputes Officer/s.

We adopt the definition of “‘complaint” in AS ISO 10002-2006, namely “ an expression of dissatisfaction made to an organisation, related to its products or services, or the complaints handling process itself, where a response or resolution is explicitly or implicitly expected”. This means we will treat informal complaints seriously and refer them to IDR unless they are resolved by the end of the next business day. Any complaint which is resolved to the customer’s satisfaction by the end of the next business day (starting from when the complaint was received) will not require the full IDR process to be applied. There is no need to capture and record the complaint or respond as set out below.

Investigating Complaints

The Complaints/Disputes Officer will review the complaint carefully and promptly, taking such steps and reviewing such documents as a reasonable person would do.

Responding to complaints within appropriate time limits and referring unresolved Complaints to an EDR scheme

The Complaints/Dispute Officer will provide a written final response to the complainant within 30 days (21 days where the complaint relates to default), which states:

- – the final outcome of the dispute at IDR

- – the right to take their dispute to EDR (no matter what the result of the investigation was at IDR)

- – the name and contact details of our EDR scheme.

If the Complaints/Dispute Officer is unable to give a final response within the specified period, the Complaints Dispute Officer will, before the end of the period:

- – inform the complainant of the reasons for the delay

- – advise the complainant of their right to complain to EDR

- – provide the complainant with the name and contact details of our EDR scheme.

The complainant can go direct to EDR regarding disputes involving hardship or postponement which also involve issues with default notices.

Legal Proceedings

Unless the statute of limitations is about to expire, legal proceedings will not be commenced or continued nor will any other enforcement action be taken during the IDR period and for at least 14 days from giving a final response.

RECORDING COMPLAINTS, IDENTIFYING & RECORDING SYSTEMIC ISSUES

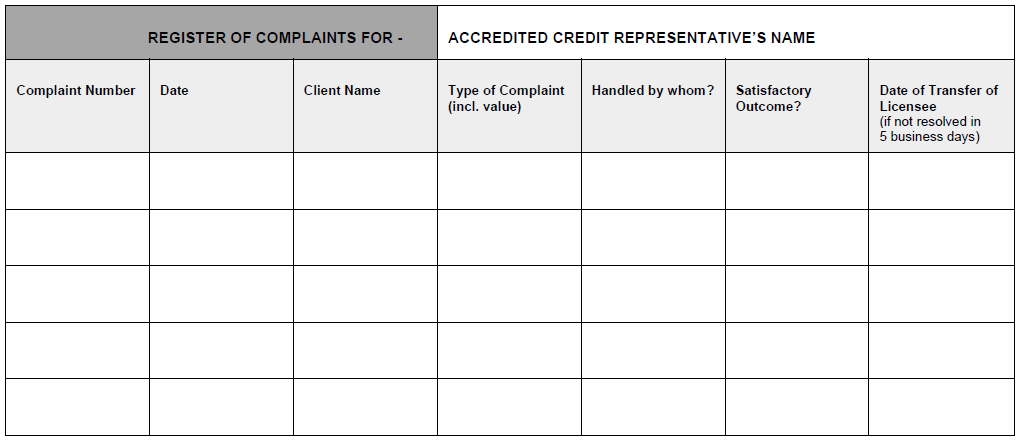

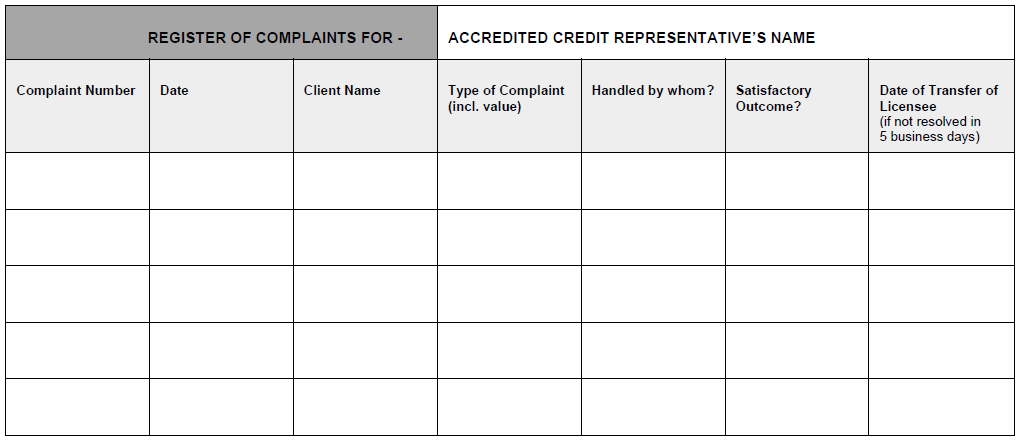

We will record information in the following tabular form, this is held within our directory:

National Consumer Credit Protection\Internal Dispute Resolution

Please ensure you follow process and procedures.

If the complaint discloses a systemic issue, the Complaints/Dispute Officer /Responsible Manager will immediately bring the matter to the attention of the Manager Compliance or Managing Director.

If a complaint is justified, the Complaints/Dispute Officer will recommend a solution comprising one or more of the following:

- – an apology

- – compensation

- – vary contractual obligations

- – a free service

Internal structures and reporting requirements

The Complaints/Dispute Officer reports directly to the business owners. The Complaints Dispute Officer will make a written report annually as a minimum. The Complaints Dispute Officer will ensure that these procedures are reviewed at least annually and a report on the review provided to the business owners.

Guiding Principles

- Visibility – We will take reasonable steps to ensure customers know about the existence of our IDR procedures and how to make a complaint or apply for hardship or postponement. This information will be readily available, not just at the time a consumer wishes to make a complaint or dispute. All staff who deal with customers, not just complaints or disputes handling staff only, should have an understanding of our IDR procedures.

- Objectivity – We will address each complaint in an equitable and objective manner. Where possible, the complaint should be investigated by staff not involved in the subject matter of the complaint.

- Charges – The IDR procedures are free of charge.

- Confidentiality – We will keep information confidential.

- Customer focused approach – We will be helpful, user friendly and communicate in plain English, showing our commitment to resolving complaints.

- Commitment – We are actively committed to efficient complaint handling. Our Procedures are published on our website.

- Analysis and Evaluation of Complaints – All complaints will be classified and then analysed to identify systemic recurring and single incident problems and trends.

VISIBILITY OF IDR POLICY

Melbourne Finance will ensure that the IDR process is recorded on our Website (www.melbournefinance.com.au) We will also ensure that any Credit Representative’s (CRs) document and provide these details to their clients.

Their disclosure documents will be required to detail that they:

- – Are a Credit Representative of Melbourne Finance or an employee;

- – That they abide by the Internal Dispute Resolution Procedures of Platform Direct Finance;

- – Melbourne Finance – Australian Credit Licence Number #387036.

- – The Credit Representatives (CR) Number

- – The Credit Representatives AFCA Membership Number

Receiving complaints

You can lodge complaints by contacting the representative acting for you or the Complaints Dispute Officer by:

- – by telephone on 03 9429 3000

- – via email at [email protected] or

- – by post at

Customer Service Team

1 Elgin Place

Hawthorn Vic 3122

You should explain the details of your complaint as clearly as you can. You may do this verbally or in writing.

When we receive a complaint, we will attempt to resolve it promptly. We hope that in this way we will stop any unnecessary and inappropriate escalation of minor complaints.

We will observe the following principles in handling your complaint:

- 1. there is no requirement for face-to-face contact between you and us, although it may be useful for us to come to a satisfactory resolution;

- 2. we expect that both parties will make a genuine attempt to resolve a complaint promptly;

- 3. we expect that both parties will provide all essential and relevant information, documents, written statements, and any other materials that may properly and reasonably be believed to assist in resolving the complaint;

- 4. we expect that both parties will comply with all reasonable requests from the other party to provide information within a reasonable time frame.

Our external dispute resolution scheme

If we do not reach agreement on your complaint, you may refer the complaint to the ASIC Approved External Dispute Resolution (EDR) Scheme, AFCA (Australia Financial Complaints Authority).

Phone 1800 931 678 or www.afca.org.au

External dispute resolution is a free service established to provide you with an independent mechanism to resolve specific complaints.